2024: A Year of Storms and Legal Challenges in the Insurance Industry

The year 2024 saw significant losses in the insurance industry due to numerous natural disasters, especially hurricanes, resulting in over $258 billion in economic losses. Claims Journal outlined key articles regarding these events and related high-stakes lawsuits involving major companies. As authorities grapple with accountability in the wake of these disasters, the impacts on the industry and consumers highlight the urgent need for enhanced measures against climate challenges.

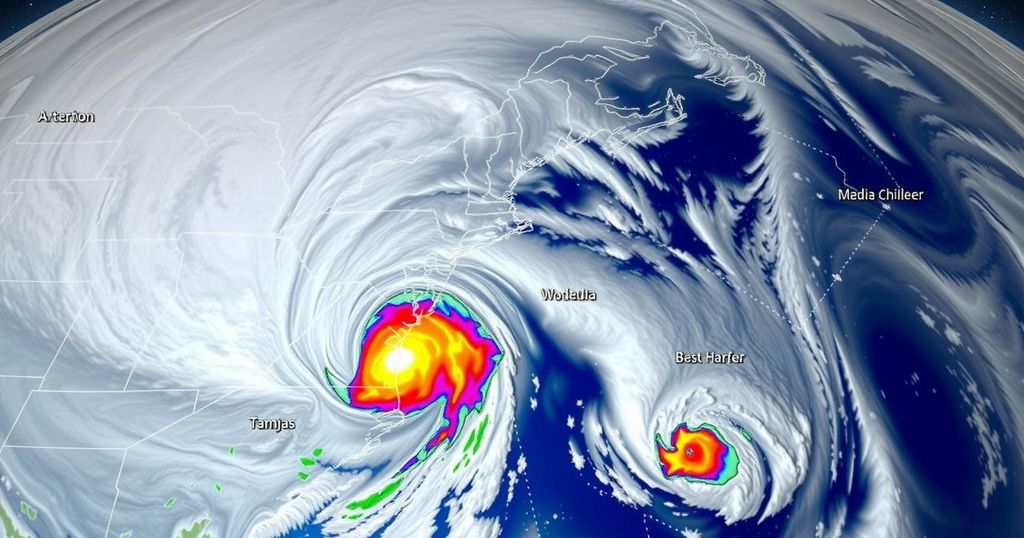

The past year has been marked by a series of significant natural disasters that have profoundly impacted the insurance industry, particularly during the tumultuous Atlantic hurricane season. Notably, named storms wreaked havoc both domestically and internationally, resulting in economic losses exceeding $258 billion and insured losses surpassing $102 billion by the third quarter of 2024. Claims Journal highlighted the most engaging stories of the year, noting the public’s keen interest in storm-related losses and claims. The most notable events included Hurricane Milton, which alone accounted for over 221,000 claims and an estimated insured loss of $2.7 billion in Florida. In the aftermath of recent hurricanes, states like Tennessee and Florida have initiated measures to enhance accountability among insurers, while major international disasters in regions like Catalonia and Taiwan have further underscored the global impacts of climate phenomena. Alongside these storms, high-profile lawsuits, including those involving prominent corporations like Meta Platforms and McDonald’s, captured significant media attention, illustrating the diverse and pressing concerns facing consumers and industries alike in 2024.

As the insurance sector navigated through unprecedented storm patterns in 2024, the impact of natural catastrophes was profound. The report from Aon plc emphasized that the insurance industry faced substantial claims-driven losses due to a combination of domestic and international disasters, raising questions about resilience and preparedness. With climate change effects increasingly manifesting in severe weather patterns, the cascading economic impacts have called for enhanced policies and regulations to protect consumers. Major lawsuits in the sector have also highlighted issues related to corporate responsibility and consumer safety, reflecting broader societal concerns amid these tumultuous times.

In conclusion, the year 2024 was dominated by severe storms, which led to considerable economic and insured losses, as highlighted in Claims Journal’s roundup of significant news. The rise in claims from hurricanes, floods, and legal actions has prompted heightened scrutiny of insurance practices and corporate accountability. As climate events continue to escalate, both local and global responses will be crucial in mitigating impacts, while ongoing legal challenges will shape public discourse and corporate governance in the industry for years to come.

Original Source: www.claimsjournal.com

Post Comment